* Updated 27th July 2025. I dont use this tool, but I believe Binance may have restricted at least the API to UK accounts, which may or may not be possible to workaround.

Another Binance trading bot

Im generally quite involved in trading and investment strategy and I like to experiment with demo accounts and small stakes exploring new features on different trading platforms using technical anaylsis and quantative modelling. I first heard about bitcoin back in 2012, and Ive had ago at trading it and some the other bigger cryptos a few times. I also followed closely the ICO boom and huge growth in crytocurrencies and ditributed ledger technologies in 2017, and look out for news updates from various channels and sources.

I wanted to try an automated style of trading, with trades based on pre-determined rules and algorithms. Obviously I a gonna need an exchange that maintains a reliable and complete API. The Binance exhange is well suited. Their API is well documented and fairly easy to use. In 2016, they held a competition inviting programmers to write their own wrapper for the API in any programming language. The best wrapper for each language would become officially supported by Binance and the creator would win 1,000 BNB. The outcome of this is that now Java, as well as 8 other languages, all have open source clients which work pretty well. There is some information about the competion here. The fact that Binance happens to be one of the biggest cryptocurrency trading exchanges, and at the time of wrting, supports over 500 currency pairs, and has a daily volume of $1,730,209,635 is obviously a huge bonus.

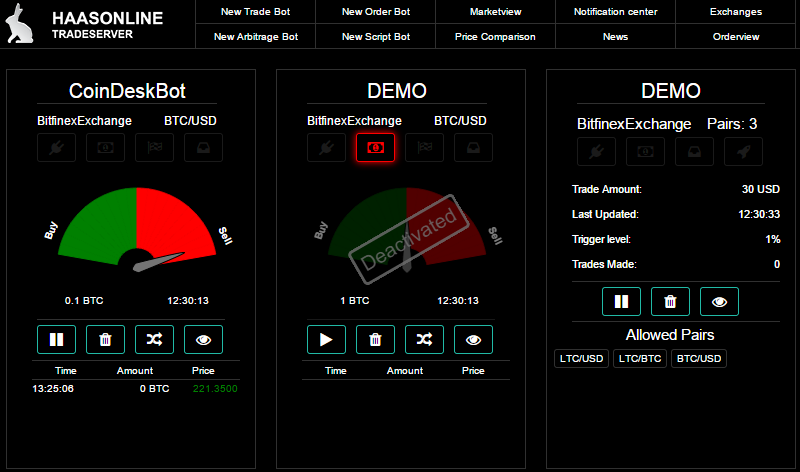

There a lot of trading bots already out there on the market. Pretty much all of them support the binance exchange and usually some other exchanges as well. Some bots, like Margin ( formerly LeoNardo ) claim to support 20 different exchanges and as a fully fledged desktop application packed for various platforms and an impressive and interactive GUI. The Gekko bot is open source and pretty well respected. Theres many more as well, offering different features. Some are open source and free to use whilst others you have to purchase. Some, like Cryptohopper are hosted on a remote server and provide a web platform for users, which is potentially advantageous, but not ideal.

Ive had a pretty quick go with all these bots, and a few more that Ive played with as well. Usually, the open source ones do have bugs. When I tried Gekko in 2018, it was too buggy to use for real trading, but this might have changed now. The fact that they’re open source is very useful as it allows you to personally examine the source code and customise it however you like, but taking a big program like these ones and understanding the code line for line is pretty time consuming and fiddly process. Ive found the paid options can also have a few bugs, and now your reliant on someone else to fix it, which could take too long, or never even happen. You can also never really be sure that the program is executing as it should and the trades you make are what they say they are. Unfortunately, trading is gambling, and the concept of a trading bot is fairly experimental and so its always a bit of a risk to pay for it when you can never be certain of making the price back. Its even worse when they wont let you try the bot before you buy it.

Ive never bought a bot, but some of them, such as Margin and Cryptohopper offer a free trial/demo version.

In the end I decided to write my own, with a client provided by the Java winner of the competion, João Silva. When you write your own, it is free, and you can personally responsible and aware of bugs, as well as implementing any feature you personally would like and you can be sure to really understand how it works also. I called my project Simple Trading Bot. I started it over a year ago, and then abandoned it when I realised that it was actually pretty difficult and fiddly to get this working smoothly and predictably, and theres alot of variables to consider other than just the exchange and the client. It was pretty unlikely to be profitable. Recently, I rewrote the whole thing and decided to have another go, this time paying more attention to code in the litte details and eventualities that really complicates the whole process. Hopefully its still simple enough to justify its name. Im at the stage now where Ive implemented most (~85%) of the necessary functionality and everyting seems to be going well, but Ill carry on testing before I deploy it live.

I havent written a GUI because I log everything extensively to dedicated log files, and I can filter and search them efficiently with another program called LogMX.

Its a desktop application written in Java 8 but with a few maven dependencies such as Spring, Guava, Ta4j, and the Binance client.

Ive open sourced the project here.

Edit 18/04/2020

Ive been working on this project on and off for a few years now, and I still work on this project whenever I get time. I would like to say that I finished an initial implementation for comprehesive live order management (on the binance exchange only), which includes mechanisms to open, update and monitor, as well as close, live orders. Ive also implemented a bunch of backtesting features for EOD datasets from Quandl. Unfortunately however, I have not found a reliable strategy yet.

Edit 28 Jul 2025

I never consistently used this tool to generate passive income, as it was designed. I also believe that recently Binance have restricted at least the API to UK accounts, which may or may not be possible to workaround._